A Little Help Makes Homeownership a Reality

Julie thought homeownership was out of reach. “I wasn’t sure if I would be able to afford a house,” they explained. “I read a report that most millennials who bought didn’t have debt and had family support.” Despite steady employment with a Pittsburgh non-profit and sufficient credit, Julie was resigned to renting, due to student loan debt and insufficient savings for a down payment. But with homeownership counseling and education, combined with down-payment assistance, today, Julie is a proud homeowner.

While attending a workshop led by NeighborWorks Western Pennsylvania, Julie learned about a down-payment assistance program and scheduled a one-on-one appointment with a homeownership counselor. Doing so provided Julie, a first-time homebuyer, a better understanding of the purchase process and a realistic assessment of the price they could afford based on their monthly budget. “It’s always helpful to know more information, to know what you’re getting into,” explained Julie. “Getting information in a straight-forward manner was useful.”

Julie’s home search in a competitive real estate market started with two failed bids, but ended successfully, when their offer on a third home was accepted. Despite the challenges of the pandemic, Julie closed on the home in April 2020.

Becoming a homeowner was a gratifying accomplishment. “I had a lot of housing instability since 2014,” Julie explained. “I could usually find someplace to stay, with a friend.” But with rents increasing in Pittsburgh, Julie wanted the stability of a mortgage payment.

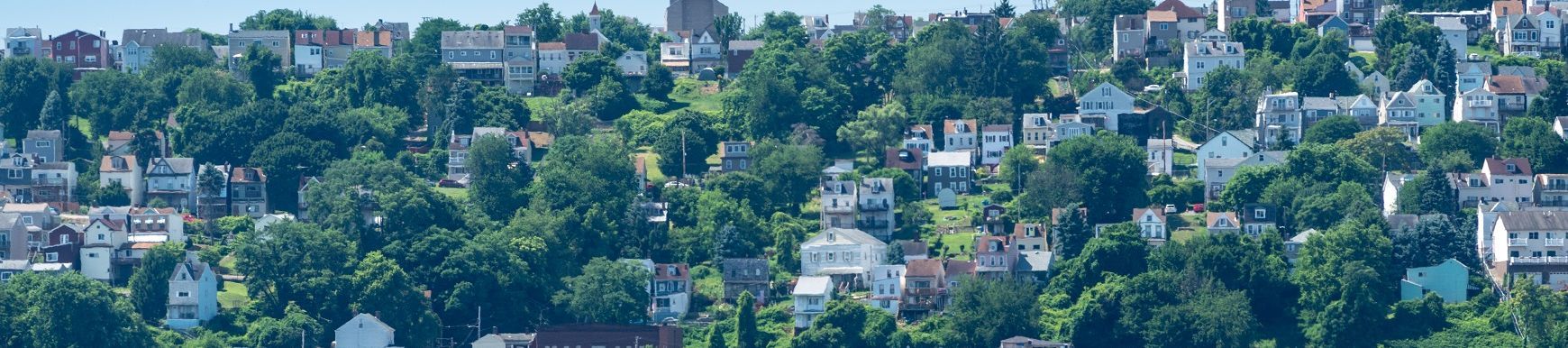

Julie is grateful for the security of homeownership and its other benefits. “I like having some outdoor space; it’s been nice to have a little area in the back and also to go out on the front porch.” The elevation of the home, in a hilly neighborhood of Pittsburgh, is special to Julie. “It’s nice to see the sky, sunset, and moon,” they added.

As an artist on the side, Julie said “it’s been fun to paint the walls the colors I want, and teaching myself basic skills like caulking.”

For other first-time buyers, Julie recommends keeping track of your finances, developing a timeline, creating a list of the things you’re looking for in a home, and learning more about the homebuying process, including first-time homebuyer programs available to you. And don’t worry if you’re not a debt-free millennial with access to family support for a down payment on a home. As Julie explains, “just because that’s the case for some people doesn’t mean it’s unattainable for others.”